See This Report about Tulsa Bankruptcy Consultation

See This Report about Tulsa Bankruptcy Consultation

Blog Article

The Greatest Guide To Bankruptcy Attorney Tulsa

Table of ContentsWhat Does Bankruptcy Law Firm Tulsa Ok Mean?The Greatest Guide To Top Tulsa Bankruptcy LawyersLittle Known Questions About Chapter 7 Vs Chapter 13 Bankruptcy.See This Report about Tulsa Ok Bankruptcy AttorneyMore About Chapter 7 - Bankruptcy Basics

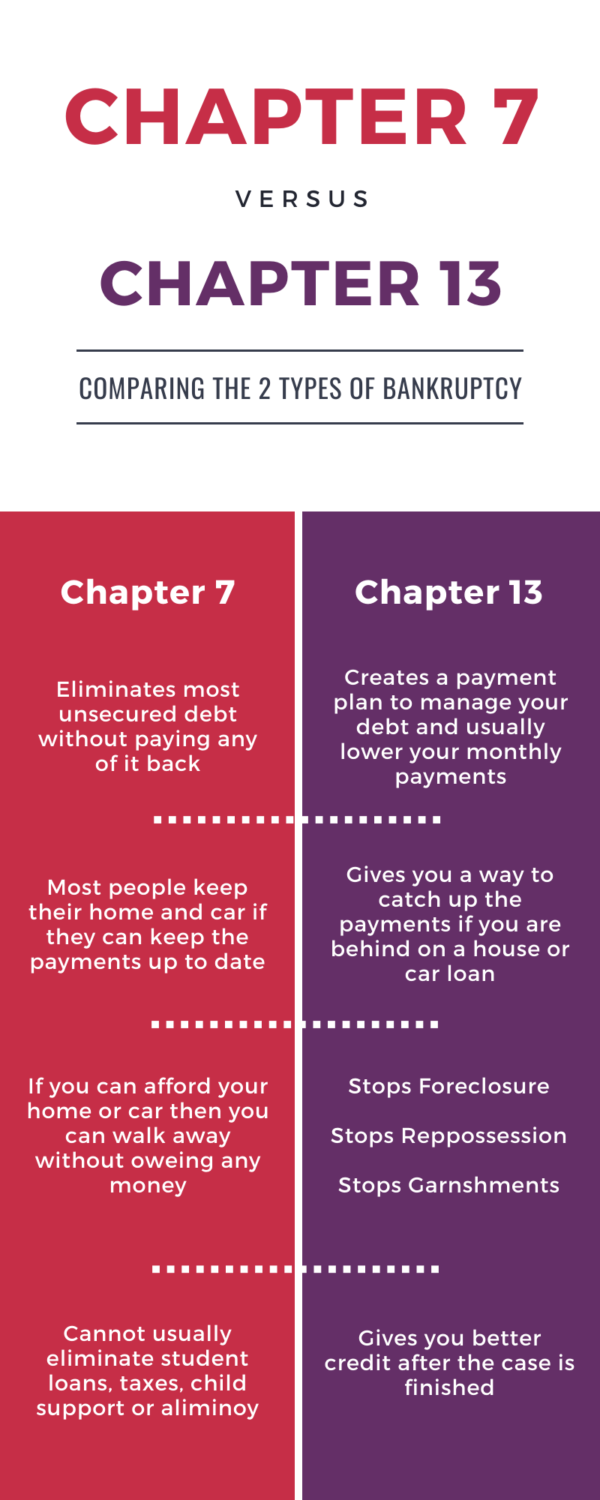

The stats for the other primary type, Chapter 13, are even worse for pro se filers. (We damage down the differences between the two enters deepness below.) Suffice it to claim, talk with an attorney or more near you who's experienced with bankruptcy legislation. Here are a few resources to locate them: It's reasonable that you could be hesitant to spend for a lawyer when you're currently under significant monetary stress.Many lawyers likewise provide cost-free assessments or email Q&A s. Take benefit of that. Ask them if personal bankruptcy is undoubtedly the best selection for your scenario and whether they believe you'll qualify.

Advertisement Now that you've decided personal bankruptcy is without a doubt the ideal training course of action and you hopefully removed it with an attorney you'll need to get started on the paperwork. Prior to you dive into all the main personal bankruptcy kinds, you should get your very own records in order.

The 5-Minute Rule for Experienced Bankruptcy Lawyer Tulsa

Later down the line, you'll really require to confirm that by divulging all sorts of information about your economic affairs. Below's a fundamental listing of what you'll need when driving in advance: Recognizing papers like your chauffeur's license and Social Security card Income tax return (approximately the past four years) Proof of income (pay stubs, W-2s, independent revenues, income from properties in addition to any kind of earnings from federal government advantages) Financial institution statements and/or pension declarations Proof of value of your assets, such as automobile and actual estate appraisal.

You'll want to comprehend what kind of financial debt you're trying to resolve.

You'll want to comprehend what kind of financial debt you're trying to resolve.If your revenue is too expensive, you have another choice: Phase 13. This alternative takes longer to fix your debts since it needs a long-term settlement plan normally three to five years before a few of your remaining financial obligations are wiped away. The filing process is also a whole lot much more intricate than Chapter 7.

The smart Trick of Tulsa Ok Bankruptcy Specialist That Nobody is Talking About

A Phase 7 insolvency remains on your credit rating record for one decade, whereas a Chapter 13 bankruptcy falls off after 7. Both have long lasting influences on your credit history, and any new debt you obtain will likely include greater interest rates. Prior to you send your insolvency kinds, you need to first complete a mandatory training course from a credit score therapy company that has actually been authorized by the Division of Justice (with the significant exception of filers in Alabama or North Carolina).

The course can be finished online, in person or over the phone. You should finish the program within 180 days of filing for personal bankruptcy.

The Facts About Tulsa Bankruptcy Consultation Uncovered

Examine that you're filing with the proper one based on where you live. If your copyright has moved within 180 days of filling, you ought to file in the area where you lived the greater portion of that 180-day duration.

Normally, your insolvency lawyer will deal with the trustee, however you may require to send out the person records such as pay stubs, tax obligation returns, and checking account and charge card statements straight. The trustee that was just assigned to your case will certainly soon establish a mandatory meeting with you, recognized as the "341 meeting" because it's a requirement of Area 341 of the U.S

You will certainly require to provide a timely checklist of what certifies as an exception. Exemptions Learn More might use to non-luxury, main cars; needed home products; and home equity (though these exemptions regulations can differ commonly by state). Any kind of home outside the list of exceptions is considered nonexempt, and if you don't offer any kind of listing, after that all your building is taken into consideration nonexempt, i.e.

You will certainly require to provide a timely checklist of what certifies as an exception. Exemptions Learn More might use to non-luxury, main cars; needed home products; and home equity (though these exemptions regulations can differ commonly by state). Any kind of home outside the list of exceptions is considered nonexempt, and if you don't offer any kind of listing, after that all your building is taken into consideration nonexempt, i.e.The trustee would not offer your sports cars and truck over here to promptly repay the financial institution. Rather, you would pay your lenders that quantity throughout your repayment strategy. A common misunderstanding with insolvency is that when you file, you can quit paying your debts. While bankruptcy can aid you clean out many of your unsafe financial obligations, such as overdue medical costs or personal lendings, you'll want to keep paying your monthly payments for secured debts if you desire to maintain the home.

The Best Strategy To Use For Top Tulsa Bankruptcy Lawyers

If you're at danger of repossession and have actually exhausted all other financial-relief options, then submitting for Phase 13 may delay the foreclosure and conserve your home. Eventually, you will certainly still require the income to continue making future mortgage payments, as well as paying back any late settlements over the program of your repayment strategy.

If so, you might be needed to provide added information. The audit might delay any debt alleviation by a number of weeks. Obviously, if the audit transforms up inaccurate information, your situation might be rejected. All that claimed, these are fairly rare circumstances. That you made it this far at the same time is a respectable indication at the very least a few of your debts are eligible for discharge.

Report this page